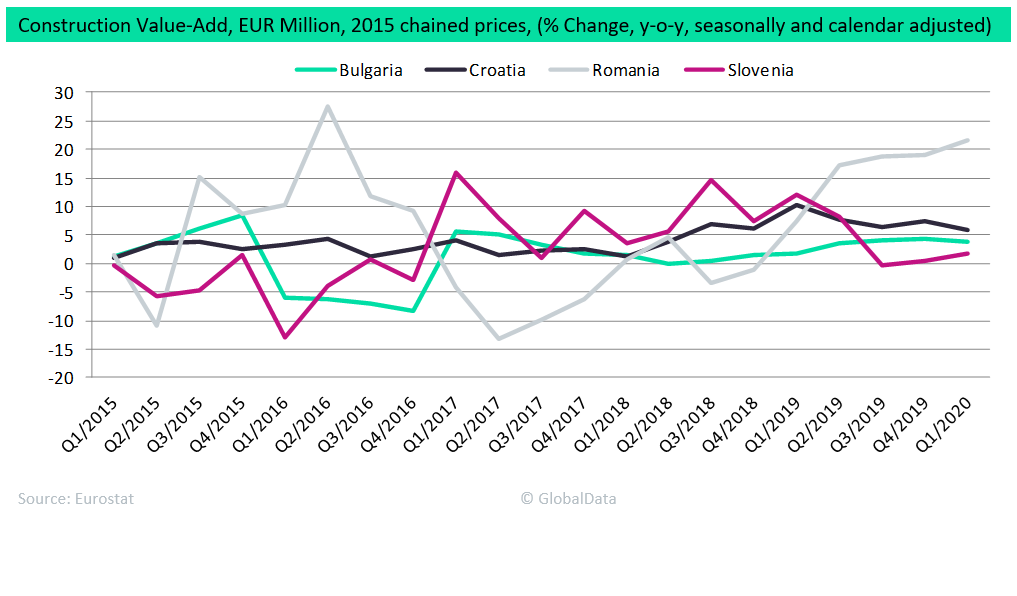

Prior to the Covid-19 outbreak, the construction industry in the Balkan countries (comprising Bulgaria, Croatia, Romania and Slovenia) was growing at a mixed pace, with growth being robust in Croatia and Romania while Bulgaria and Slovenia recorded low growth rates. However, the Covid-19 crisis has created economic disruption in the region, with containment measures bringing many key sectors to a standstill and causing a slowdown in the construction industry.

Unlike Western Europe, the Covid-19 outbreak has been fairly restricted in the region, with Romania having the highest number of cases and deaths. As a result of the lower prevalence of cases, the lockdown too has not been as severe as in the Western European countries and consequently the construction industry has been allowed to operate in most of the countries, although projects have been affected due to social distancing and safety measures.

According to Eurostat, the Romanian construction industry grew by 21.5% year-on-year in Q1 2020, while in Croatia, Bulgaria and Slovenia, construction grew by 5.8%, 3.7% and 1.7% respectively. Growth momentum in Croatia was driven primarily by the civil engineering segment, which expanded by 7.2% in Q1 2020, while buildings construction grew by 5.6%. In Slovenia, the civil engineering segment grew by 6.2% in Q1 2020, however buildings construction was down by -1.7% during the same period.

Romania is the worst-affected country in the Balkan Peninsula in terms of confirmed Covid-19 cases. The country had reported 27,296 coronavirus cases and 1,667 deaths as on 2 July. The Romanian Government has taken various measures to contain the spread of the virus, including the declaration of a state of emergency, travel and domestic movement restrictions, social distancing, a shutdown of non-essential shops, closure of schools and ban of public gatherings in mid-March. To mitigate the effects of Covid-19 on the economy, the government allocated a stimulus package of around 2% of GDP in March in a bid to support sectors affected by the Covid-19 epidemic. In Romania, construction works were not severely affected by the government’s containment measures, as there was no regulation on the mandatory shutdown of the industry. Although work was impacted by the shortage of materials and workforce, the disruptions caused were minimal.

Moreover, work progressed faster than scheduled on some bridge and road construction projects due to the reduced traffic levels. In May, the country’s Prime Minister, Ludovic Orban promised to launch a comprehensive package with an aim to restart the economy, with massive investments on infrastructure projects. Mr Orban said that the government wants to allocate 6% of the GDP for public projects over the next two years, including investments on energy, transport, health and education infrastructure. He also assured that these projects will offer employment to most of the 700,000 Romanians who are currently unemployed.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataBulgaria has reported 5,154 Covid-19 cases and 232 deaths as on 2 July. To contain the virus outbreak, initially, the National Assembly of the Republic of Bulgaria declared a State of Emergency in March. The government also took various measures to contain the spread of the virus, including the closure of schools, kindergartens, universities, restaurants, bars, movie theatres, gyms, retail trade except for essential goods and services, travel restrictions and banned social gatherings. In late June, the government extended the state of emergency until 15 July due to the rise in the number of newly registered cases. To support businesses affected by the coronavirus outbreak, the government announced a financial aid package worth BGL4.5bn ($2.5bn) in late-March. Construction activities were also disrupted due to the Covid-19 outbreak. On 30 March, Iliyan Terziev, head of the Bulgarian Construction Chamber, stated that Bulgaria’s construction sector had lost $56m in the first two weeks of March as a result of project delays caused by the pandemic. Nevertheless, the government wants to speed up its plan to complete the 474km pipeline on the Bulgarian stretch, which will bring Russian gas to Europe, by the end of 2020. The government will also attempt to boost infrastructure spending to stimulate the economy. On 1 May, the government issued tender of BGL268.5m ($148m) for the construction of road tunnel at Shipka peak beneath the Balkan Range.

In Croatia, 2,831 cases were recorded with 108 deaths since the start of the Covid-19 pandemic. While the government has imposed measures to contain the pandemic, including the closure of schools and universities, shut down markets, travel restrictions and border closures, the construction industry was not completely shut down. In late April, the Transport and Infrastructure Minister emphasised that the government is continuing to implement large infrastructure projects, including the Istrian Y motorway project, Peljesac Bridge, the Vc corridor, and several railway projects. Moreover, the Regional Development and EU Funds Minister said that work on the EU-funded projects was ongoing, although a portion of the funds was redirected for the procurement of medical equipment. In mid-May, the state secretary for infrastructure said that the country is witnessing an increase in the financing for transport infrastructure projects. Construction projects are being developed using several sources of financing, including EU funding, private-public partnerships, and through concessions. This will provide some boost to the implementation of public infrastructure projects in the future.

In Slovenia, the tally of the Covid-19 cases stood at 1,613 with 111 deaths as on 2 July. Although the government has imposed several restrictions to contain the pandemic, including the shutdown of non-essential shops, restaurants and public transit, closure of schools and border checks, construction activities continued to progress with government guidelines to ensure the safety of workers. The construction project pipeline contains the majority of the projects on railway infrastructure, and in the latest development, the state-run company – 2TDK shortlisted ten consortiums for construction of the second track of Divaca-Koper railway line. The project involves the construction of a 27.1km track, which will be able to handle a capacity of 231 trains per day. The company also signed a 20-year loan agreement worth €112.m ($125.8m) with local lender Nova Ljubljanska Banka (NLB) to co-finance the project. The €1.2bn ($1.3bn) railway line project will be financed through investments by the company, loans from commercial banks, EU grants and EIB lending.

As a result of the containment measures and policies, GlobalData expects growth will be adversely affected in the region in the short term, with the Croatian construction industry expected to decline by 3.7% in 2020, while the Slovenian construction industry is expected to contract by 2.6% and the Bulgarian construction industry by 2.1% during the same period. On the other hand, growth in the Romanian construction industry is expected to decelerate to 3.3% after growing by 17.1% in 2019. GlobalData expects the construction industry in the Balkan Peninsula to regain growth momentum in 2021, driven by the government’s efforts to boost construction spending to stimulate the economy and a projected recovery in consumer and business confidence.

Related Company Profiles

NLB Corp