GlobalData expects Mexico’s construction industry to grow by 5.4% in real terms in 2022, supported by the ongoing recovery in construction activities, improvement in construction confidence and increase in gross fixed investment, coupled with the government’s investments to advance ongoing infrastructure developments, combined with additional investments to restart delayed projects. In May 2022, the Secretariat of Infrastructure, Communications and Transportation (SCIT) announced that the country’s public and private sectors will invest at least MXN768 billion ($37.6 billion) in road and rail infrastructure in 2022.

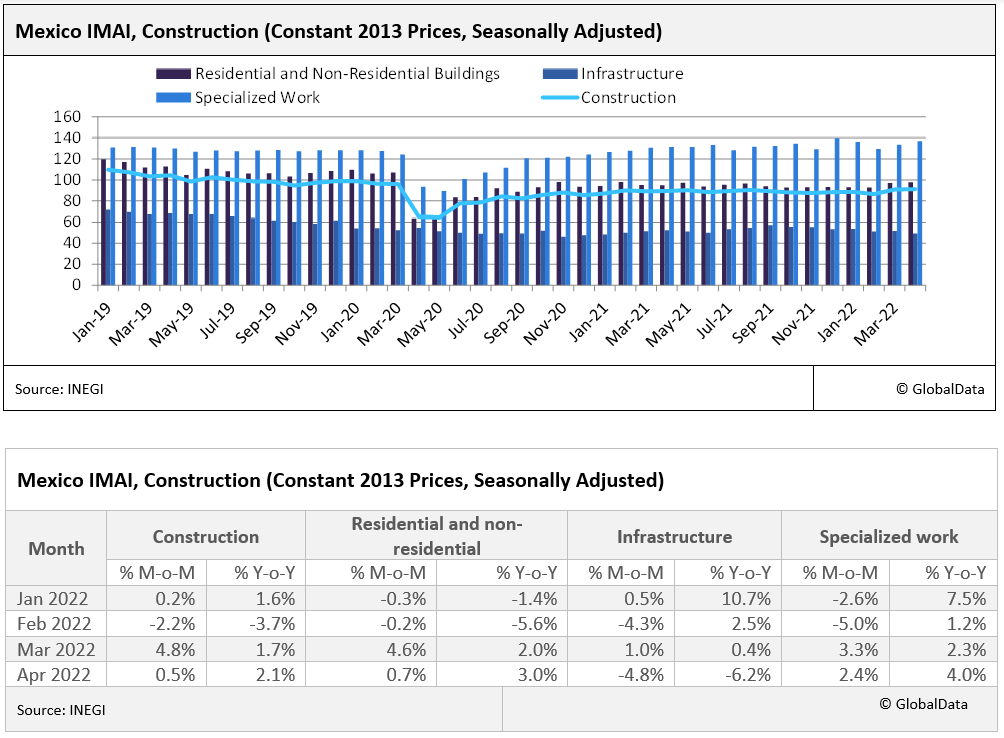

The Monthly Indicator of Industrial Activity (IMAI) from the National Institute of Statistics and Geography (INEGI), which is closely linked to the GDP value add construction data, showed that the construction industry registered growth for the second month in a row in April 2022, with index registering growth of 2.1% year on year (YoY) that month, preceded by a Y-o-Y growth of 1.7% in March and decline of 3.7% in February 2022. The rise in activity in April was driven by the residential and non-residential building and specialized work segments, which rose by 3% YoY and 4% YoY respectively on the month compared to decline of 6.2% for the infrastructure segment. In cumulative terms, the average construction activity index posted growth of 0.4% in the first four months of 2022, increasing from 88.9 during January–April 2021 to 89.2 during the same period of 2022. In terms of segmentation, specialized work and infrastructure activities grew by 3.7% and 1.7% in the first four months of 2022, respectively, whereas residential and non-residential building activity declined marginally by 0.5% during the same period.

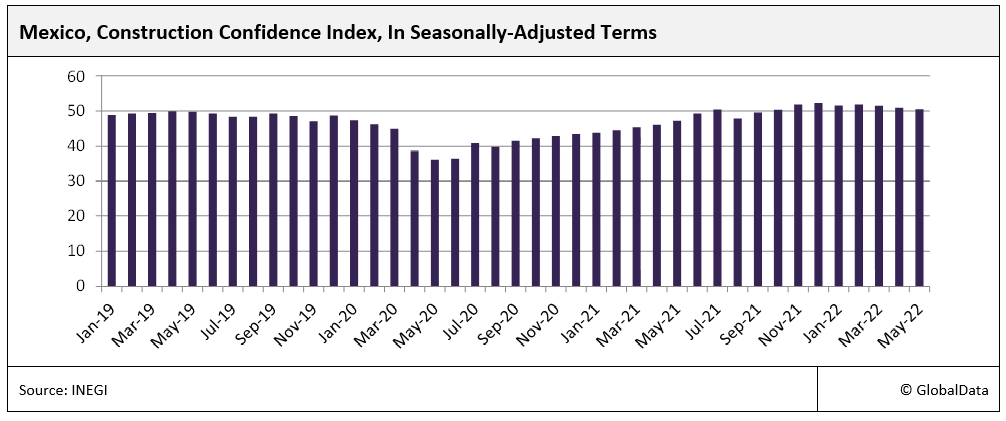

According to the latest Monthly Business Opinion Survey conducted by INEGI, confidence in the construction industry continued to expand, with the index registering a score of 50.5 in May 2022 (the latest data available at the time of writing); this marks the eighth straight month with a score of over 50 (the threshold which separates expansion from contraction). In cumulative terms, the average construction confidence index rose from 45.3 points during January–May 2021 to 51.3 points during January–May 2022.

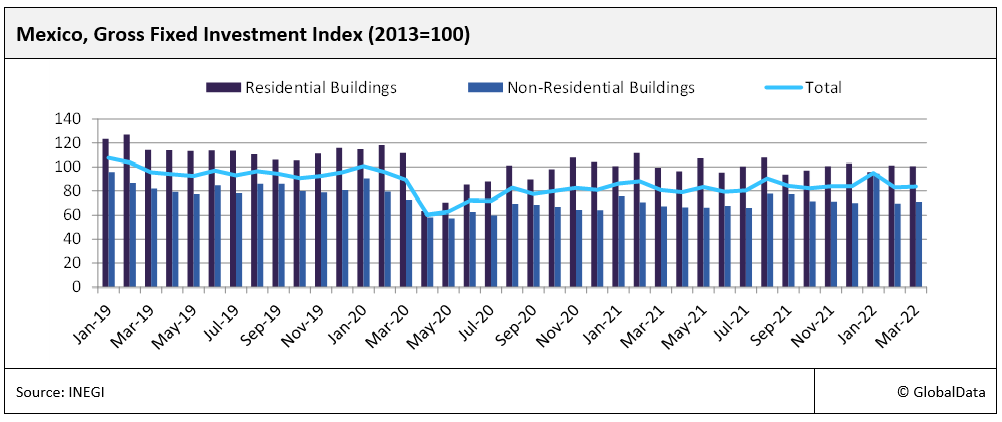

The industry’s buildings output is also expected to be supported by the increase in fixed investment on buildings. According to the INEGI, the gross fixed investment on buildings recovered by 3.6% YoY in March 2022, compared to a Y-o-Y decline of 5.8% in February and a growth of 10.4% in January 2022. This recovery is attributed to a rise in the gross fixed capital formation of both residential buildings (1.4% YoY) and non-residential buildings (6% YoY). In cumulative terms, the gross fixed capital formation on buildings rose by 2.7% in the first three months of this year, while in terms of segmentation, it rose by 10.2% for non-residential buildings and fell by 4.4% for residential buildings during the same period.

GlobalData expects Mexico’s construction industry to record an annual average growth rate of 2.3% over the remainder of the forecast period (2023–26), supported by investments in residential, transport, electricity, Liquefied Natural Gas (LNG) and telecommunication infrastructure projects. In May 2022, the largest Mexican financial institution, BBVA México, announced that it will grant MXN92 billion ($4.5 billion) in loans to the country’s housing sector this year. Despite maintaining its growth momentum, Mexico’s construction industry output is only expected to return to pre-pandemic levels in 2026. Surging inflation, high construction material cost and supply chain and logistical disruptions will continue to weigh on construction output growth in the short term.

See Also:

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalData