European architects are facing the prospect of a sharp fall in housing work next year as the new house-building sector feels the impact of the subprime crisis in the US and the collapse of the Spanish market. The warning comes in new figures from Euroconstruct, published at the end of November at its latest twice-yearly meeting, in Vienna, Austria.

NEW HOUSE BUILDING

New house building is regarded as a weather vane, both for the health of economy and construction as a whole, and has been a key factor in the growth seen in recent years.

However, Patrick de la Morvonnais, of the French economic institute, BIPE, said there is no doubt that the sector is now heading into difficulties. "There are unmistakable signs of a downturn in the European market: a fall-off in housing loans owing to tougher lending conditions, sagging or even falling real estate prices, increased inventories of unsold houses and a worrying loss of household solvency," he said.

As a result, the forecasters have sharply downgraded their figures and are now predicting that output in the new housing sector will fall in every year from 2007 through to 2009, a total real-term drop of just over 7%.

The UK is predicted to perform better than the European average, suffering a 0.7% contraction in 2008, but growing steadily by 2.3% and 2.8% in each of the two years after that. But it is the picture in Spain, Europe's biggest housing market, which is causing most

concern.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

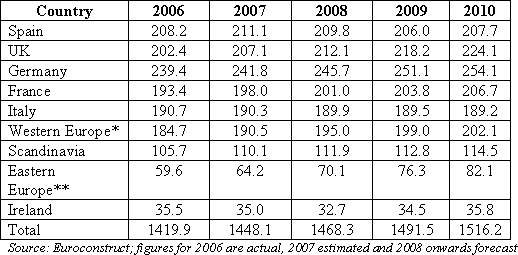

By GlobalDataSpanish completions are expected to peak in 2007 at 775,000 out of a total across all 19 Euroconstruct countries of just under 2.6 million. But they are now expected to tumble by 26% to just 570,000 by 2010, a fall of 205,000, which is about the same as the entire German market. The Italian market is predicted to fare little better with a drop of 17% over the same three-year period. Completions in France and the UK will fall slightly, and in Germany will grow by 6%.

De la Morvonnais said the state of the Spanish market does not mean that concerns about the state of the residential sector in Europe as a whole are misplaced. "But omitting Spain from the figures means the decline is much less sharp in 2008 and the projection for 2009 and 2010 is stagnation rather than decline."

Dr Margarete Czerny from WIFO, the Austrian Institute of Economic Research, underlined the pessimistic mood: "when housing slows down, it affects the entire European construction sector. In recent years, construction was a significant engine in driving the overall European economy. This is now over. Construction can no longer be an engine for GDP growth."

The total forecasts, including housing, non-residential building and civil engineering, predict that output will rise by 1.4% and 1.6% in 2008 and 2009 – a cut of 0.4% a year compared with the last set of forecasts published in the summer. This represents a reduction in construction work worth €30bn over the two-year period.

COMMERCIAL BUILDING

Many commentators have been expecting the commercial building sector to follow new housing and contract, but so far the picture remains optimistic. Total non-residential building is expected to perform well, although growth will slow from 4.4% in 2007 to 2.0% in 2010.

Pekka Pajakkala of the Finnish economic research centre VTT, said the outlook remains favourable for the near future, despite recent market concerns. "This year, 2007, is turning out clearly better than we forecast in June. Growth is expected to slow down after 2008, but should remain steady. The favourable economic outlook is due to demand from both public and sectors, the activities of international property investors, the increasing quality requirements from business, industrial and

office clients as well as the growing role of the service sector."

The overall figures also mask a sharp divide between East and West. Western Europe will grow in real terms by just 1% and 1.2% in 2008 and 2009, the experts say. Over the same period, the East will rise by 9.2% and 8.8%. The star performer is Poland where total output is expected to rise by 40% between this year and 2010, with spending on civil engineering projects expected to grow by over 31% in real terms in 2008 alone.

In the four years to 2010, the Polish civil sector is predicted to more than double, from output of €8.8bn in 2006, to over €17.5bn in 2010.

"Civil engineering is the driving force of construction output in Poland," said Czerny. "The Polish government has developed a new programme for national roads and transport infrastructure is supported by the EU."

Despite the spectacular growth in the east, it is the fortunes of the so-called big five – Germany, France, Italy, Spain and the UK – that have most impact on European markets. Between them they account for 70% of total output. Only the UK is predicted to show any consistent and significant growth – between 2.4% and 2.7% between 2008 and 2010 – thanks in part to the effect of the 2012 Olympics in London. France and Germany will also show real terms growth, although at a slower rate. But output in both Spain and Italy is expected to fall.

For civil engineers, the picture remains upbeat, with growth expected to climb from 3.2% this year to 4.0% in 2009, before dipping back to 3.0% in 2010. Erich Gluch from Germany’s prestigious Institute for Economic Affairs, said that if these figures prove correct, the sector will have expanded for a record 11 years in a row.

A BRIGHT FUTURE?

Causes for optimism included European governments' increasing interest in transport; the further development of public private partnerships and the growing importance of environmental issues. As a result, Mr Gluch said he remained confident about the sector’s long-term prospects.

"In the near future, civil engineering activity will focus on the maintenance and renewal of the water supply infrastructure. Also, investments in productive capacity and sustainability in the energy sector will strengthen the sector." Mr Gluch continued.

And despite much government talk about the need to invest in railways and public transport, instead of roads, there is no evidence of this actually taking place on the ground. Road spending is forecast to account for 38% of civil engineering spending between 2007 and 2010, slightly up in the previous four years.